Investment guidance at a glance

- The National Reconstruction Fund Corporation (NRFC) was created to help diversify and transform Australia’s industry and economy.

- The NRFC can invest in debt and equity and can provide guarantees. Our benchmark return is the 5-year Australian Government bond rate plus 2-3%.

- We invest across 7 priority areas:

- Renewables and low emission technologies

- Enabling capabilities

- Defence capabilities

- Transport

- Value-add in resources

- Value-add in agriculture, forestry and fisheries

- Medical science.

- The NRFC provides investment to early-stage startups, growth-stage companies and mature businesses.

- The NRFC can not provide grants and can not directly finance the extraction of coal or the extraction of natural gas, the construction of pipeline infrastructure, or native forest logging.

- The NRFC welcomes proposals that meet our investment guidance as outlined below.

- This guide provides an overview of our investment requirements and process. It is not intended to be an investment policy for the purposes of section 75 of the National Reconstruction Fund Corporation Act 2023(Opens in a new tab/window) (the NRFC Act).

Eligibility

We consider debt, equity and guarantee opportunities consistent with the requirements set out in the NRFC Act and our Investment Mandate. This includes proposals that:

- are solely or mainly Australian based

- align with at least one of the seven priority areas

- are not prohibited investments (including coal or natural gas extraction, the construction of pipeline infrastructure, or native forest logging)

- demonstrate a risk/return profile that is consistent with our Investment Mandate

- have regards to our legislated public policy outcomes

- have an Australian Industry Participation Plan(Opens in a new tab/window) if required.

Investment criteria

Return

The NRFC targets a portfolio rate of return of 2-3% above the 5-year Australian Government bond rate over the medium to long term.

Risk appetite

The NRFC will consider higher risks for investments that are in emerging technologies and industries, investments that support Australia’s strategic interests or investments with long-term payback periods. Our risk evaluation considers financial and non-financial consequences, including reputational risk.

Positive policy outcomes

NRFC investments must have regards to the policy outcomes set out in the NRFC Act and the Investment Mandate including:

- growing or improving industrial capability

- helping industry pursue value-adding opportunities

- improving economic diversity

- crowding-in private finance

- decarbonisation

- creating secure jobs and a skilled, adaptable workforce

- boosting supply chain resilience

- commercialising Australian innovation and technology

- improving economic participation by historically underrepresented groups

- sustainability and circular economy principles and solutions

- regional development

- national security.

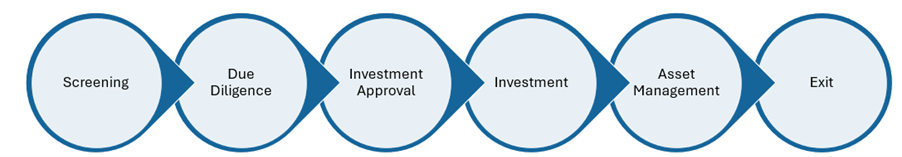

The NRFC investment process

The NRFC invests with rigour, professionalism and a focus on outcomes. Our investment process is transparent, repeatable and scalable. It encompasses 6 main steps as shown in the diagram below.

Proposals that are eligible and meet the criteria outlined above, proceed through due diligence.

What does a good proposal look like?

Factors considered during due diligence include, but are not limited to:

- scalable business model

- innovative product, process or service

- large and accessible total addressable market

- strong product market fit

- unique intellectual property and adequate intellectual property protection

- strong competitive position with high moats and high barriers to entry

- appropriate use of proceeds

- reasonable valuation (for equity)

- satisfactory credit quality consistent with internal risk metrics (for debt)

- return time frame consistent with mandate

- experienced management team

- evidence of delivery against operational and financial targets

- consistent and accurate financial disclosures

- robust governance

- investment readiness

- pathway to exit or other liquidity event.

Throughout this process, the NRFC commits to:

- working with businesses and entrepreneurs to understand investment proposals

- communicating openly and honestly about investment requirements and information needs

- respecting the confidentiality of any information provided to us

- acting with professionalism and integrity at all times.

Next steps

- Contact us via our website for more information

- Use our online form to share your investment proposal with the NRFC